The negative return was mainly due to the pick-up in Treasury yields, particularly after May 2013 when talk of tapering emerged. Spreads on Asian bonds performed well, with the overall spreads steady at 260bp despite the ructions in market.

The outlook for 2014 will again be dependent on both Treasury yields and the underlying credit fundamentals. With the Fed poised to taper the quantitative easing over the course of the year, and as the US economy continues to accelerate, we can expect further increases in Treasury yields. After the 10-year Treasury yields have already touched 3%, they are unlikely to rise at the same pace as last year, and a rate in the mid-3% area for 10 years seems appropriate for the end of 2014.

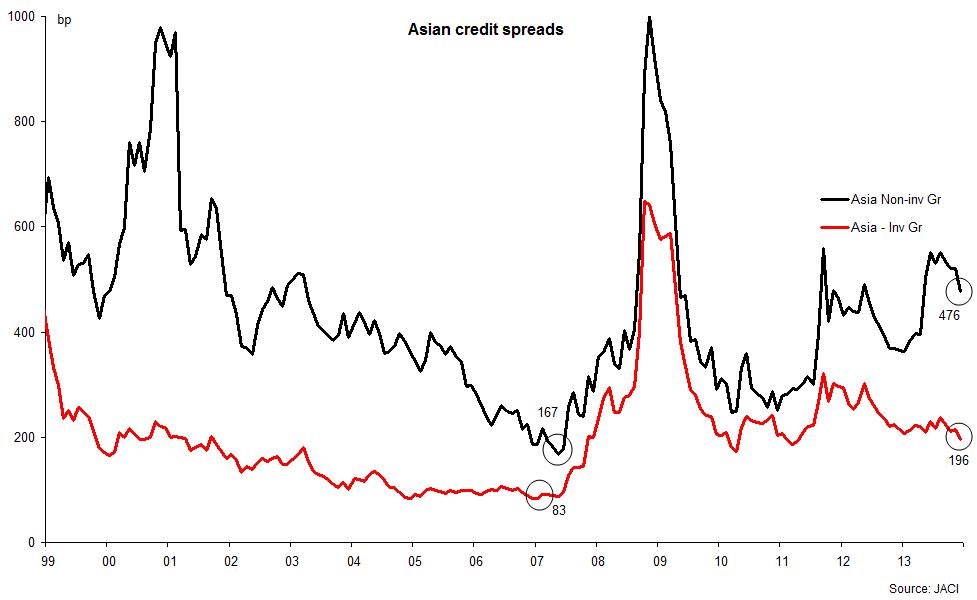

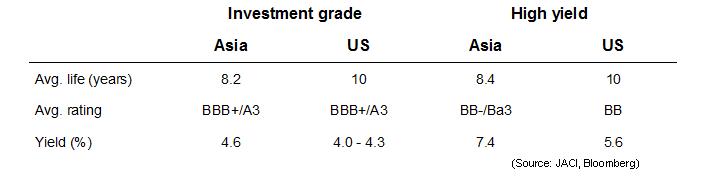

Asian spreads are still higher than their pre-crisis levels (see chart below). In addition, the table below shows that Asian dollar bonds provide a yield pick-up over US bonds for same/higher ratings and shorter maturities. The yield pick-up is about 30-60bp for investment-grade and about 180bp for high-yield bonds. Given these factors, there is scope for a further contraction in Asian spreads by 25-50bp. This should cushion the impact of the expected rise in Treasury yields.

If Treasury yields rise and spreads contract, the net effect could still lead to a positive return for Asian credits as a whole. The average yield on Asian bonds is 5.3%, composed of 4.6% for investment grade and 7.5% for high yield, according to JACI. As long as Treasury yields do not rise steeply, the overall return should be close to the yield. Of course, the net return depends on the extent to which Treasury yields rise.

For instance, if 10-year Treasury yields reach 3.5% and spreads contract 25-50bp, then the total return could reach close to 4%.

With the Asian credit universe, high-yield corporates are once again set to outperform investment-grade credits. High-yield bonds should do well as long as default rates stay low and the refinancing environment remains comfortable. Hence it makes sense to overweight high-yield bonds in Asia.

That brings us to the concept of the two interest rates: one that applies to the investments and the other to leveraging the portfolio. Over the course of this year, as the Fed tries to taper down its quantitative easing, longer-term interest rates are set to rise further, negatively affecting the market values of bonds. Hence, it is important for investors to focus their portfolios towards the short-to-medium-term maturities of, say, around 5-7 years.

The short-term interest rates, on the other hand, are likely to stay low, as the Fed will continue to keep the short-term rates close to zero for an extended period of time, perhaps until the end of 2015, and raise the rates only in small steps after that. Investors can use this to leverage their portfolios by borrowing short-term funds.

There is one final element in the construction of the portfolio strategy in Asian credit, and that is to choose credits carefully with regards to their fundamentals. While the refinancing environment may be reasonably easy in 2014, the same cannot be said of the years after that. As liquidity tightens in 2015 and as cost of funds rise, not all the borrowers will find it easy to refinance maturing debt. That in turn could lead to mark-to-market losses for weaker credits, perhaps later in 2014 or beyond. Investors must position their portfolios by carefully avoiding such weaker credits.

So, let’s put together the main elements of the suggested investment strategy in Asian credits:

- Keep the portfolio maturity towards the lower end, i.e., 5-7 years.

- Continue to employ leverage to improve returns.

- Overweight high-yield over investment-grade.

- Choose the credits carefully and avoid fundamentally weaker credits, even if their yield is attractive.

By carefully managing the portfolio, it is possible to generate returns of up to 8-10% from Asian dollar bonds for 2014.

RSS Feed

RSS Feed