One year ago, when Bernanke first mentioned the possibility of tapering, the asset markets took fright that the Fed would take away the punch bowl. The U.S. Treasury yields spiked immediately, leading many commentators to predict an Armageddon in the fixed-income markets resulting from a combination of rising rates, falling asset prices, shifting of funds to equity markets.

However, the reality so far has turned out to be very different. As the Fed began the actual tapering, interest rates have gone down this year. The 10-year Treasury yields ended the last year at 3%, but have since retreated to 2.6%, reflecting the hesitant performance of the U.S. economy as well as the additional monetary stimulus from Japan and the possibility of a stimulus from the ECB.

Neither has the “great rotation” out of fixed income into equities materialized. The equity funds covered by EPFR have received USD 46 bn of inflows this year, while the bond funds have gathered USD 84bn. It is interesting to note that both figures are lower than those recorded in the same period last year (USD 140 bn for equity and USD 100 bn for bonds). However, these figures mask a striking contrast between developed-market and emerging-market funds: the former gained USD 68 bn in equity and USD 90 bn in bonds, while the latter lost USD 23 bn in equity and USD 7 bn in bonds.

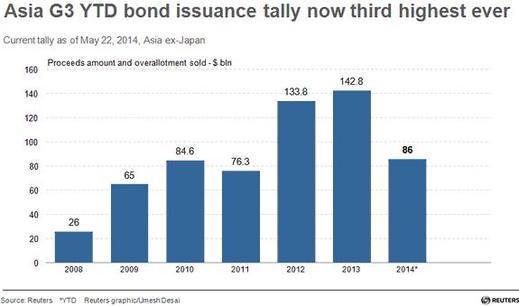

If one were to observe the Asian USD bonds, however, one would certainly believe that the good times are still rolling on. New bonds worth USD 80 bn have been issued in the first five months of 2014, at par with the corresponding period of last year. (Note that the chart below includes EUR and JPY as well).

However, the reality so far has turned out to be very different. As the Fed began the actual tapering, interest rates have gone down this year. The 10-year Treasury yields ended the last year at 3%, but have since retreated to 2.6%, reflecting the hesitant performance of the U.S. economy as well as the additional monetary stimulus from Japan and the possibility of a stimulus from the ECB.

Neither has the “great rotation” out of fixed income into equities materialized. The equity funds covered by EPFR have received USD 46 bn of inflows this year, while the bond funds have gathered USD 84bn. It is interesting to note that both figures are lower than those recorded in the same period last year (USD 140 bn for equity and USD 100 bn for bonds). However, these figures mask a striking contrast between developed-market and emerging-market funds: the former gained USD 68 bn in equity and USD 90 bn in bonds, while the latter lost USD 23 bn in equity and USD 7 bn in bonds.

If one were to observe the Asian USD bonds, however, one would certainly believe that the good times are still rolling on. New bonds worth USD 80 bn have been issued in the first five months of 2014, at par with the corresponding period of last year. (Note that the chart below includes EUR and JPY as well).

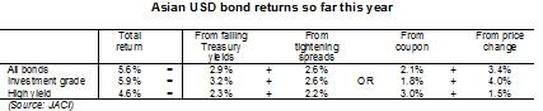

Asian USD bonds have so far produced a total return of 5.6% (see table below), split roughly equally between the returns from the falling US Treasury yields and the tightening spreads. Split another way, coupons have generated about 2% so far, while rising bond prices (both due to US Treasury and spreads) have produced 3.4%. The table below shows that investment-grade has outperformed high-yield so far. This is mainly thanks to the concerns over the Chinese property credits and the impact of the falling coal prices on Indonesian mining credits.

This total return looks quite respectable when viewed against the overall equity market performance. MSCI Asia ex-Japan equity index is up 2.8% this year, thanks mainly to emerging markets such as India. Hang Seng, on the other hand, is flat.

Regular readers of this blog may remember our recommendation for this year to overweight high-yield. We still expect high-yield to outperform investment grade. While we still believe in that prognosis, investors would be well advised to follow two other broad strategies:

Regular readers of this blog may remember our recommendation for this year to overweight high-yield. We still expect high-yield to outperform investment grade. While we still believe in that prognosis, investors would be well advised to follow two other broad strategies:

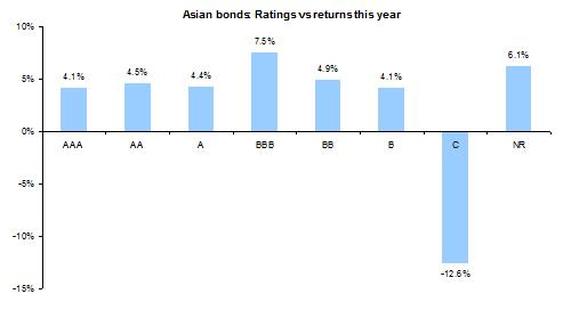

- Stick to better quality names: While liquidity is still comfortable, there will come a day when companies with lower credit quality will find it difficult to refinance themselves. Already, bonds with lower ratings have underperformed: as the chart below shows, the best returns have come from “BBB” bonds, while the worst have come from “B” and “C” rated bonds.

- Control the duration: While the decline in the interest rates have taken many people by surprise, thereby enabling the longer-duration paper to do well, it is difficult to conceive of the rates falling further. In fact, discussions have already started in the Fed about when the first rate increase should take place. At this juncture, it is better to shorten the maturity of the portfolio towards five years rather than longer. Many perpetual bonds look increasingly riskier, unless the issuer has a strong incentive to call the bonds earlier.

RSS Feed

RSS Feed